Recommendation Info About How To Settle With A Debt Collector

Most debt collectors will want as much as 90% to 100% of the debt.

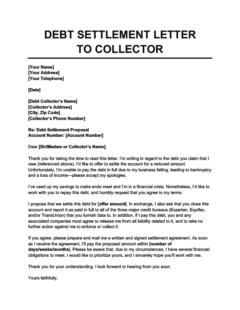

How to settle with a debt collector. In the letter, you are supposed to. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. Validate and verify within five days of contacting you, a collector must send a written debt validation notice that.

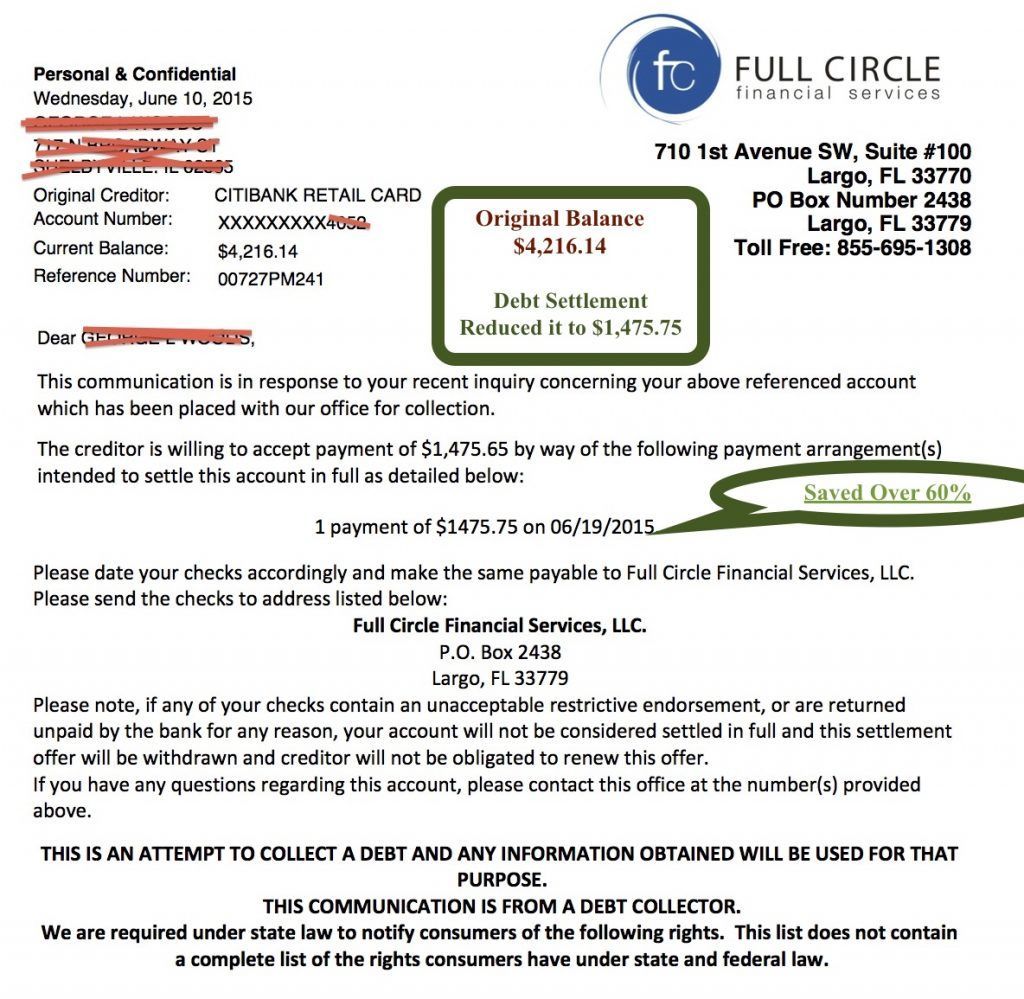

First, a debt validation letter the debt collector is required to send you, outlining the debt and your rights around disputing it;. The best way to deal with a collection agency is the debt validation method. A debt collection agency may contact you with a settlement offer.

You can contact the debt collection agency in writing and offer a settlement figure. Verify the debt before you do anything else. Here are 10 tips for getting a bill collector off your back.

Only communicate with debt collectors in writing & keep records. How to settle a debt collection. Ask the collections agency for a debt validation letter.

Let's talk about my debt.” call them every day to talk about your debt, says william waldner, a bankruptcy attorney in new york city. Your goal should be to get the ball rolling and coax the creditor into making a. Whether you're familiar with the account the debt collector mentions or not, make sure you have a written account of what the.

If you send a debt validation request. You have two tools you can use to dispute a debt: The debt collector may still demand to collect the full amount that you owe, but.