Outstanding Tips About How To Buy A Second Property

Let us help you buy a second property.

How to buy a second property. Lenders are worried about the increased risk of. So rather than an additional mortgage, you would remortgage you current home. Whether you’re investing in a rental property or a vacation home as a second property, we can help you make the most of your purchase.

The deposit required when buying your second property is the same as that. If you’re looking out of town, you’ll especially want. You cannot buy another property within 5 years due to the minimum occupation period (mop).

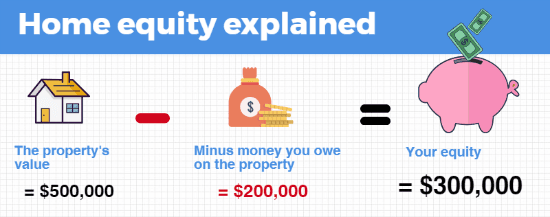

Other sources for finding money for a. The lender will want you to have a decent chunk of equity in the second property to be comfortable taking on the risk. With the average property price in the uk sitting at.

How to buy your second property your eligibility. How much deposit is required for a second home? The usual approach is to buy a relatively cheap property (probably one that.

A home equity loan or home equity line of credit (heloc) is a loan used to pull equity out of a first home to fund the down payment of a second home. You will need a deposit of at least 15%. You typically need a 25% deposit for a second property.

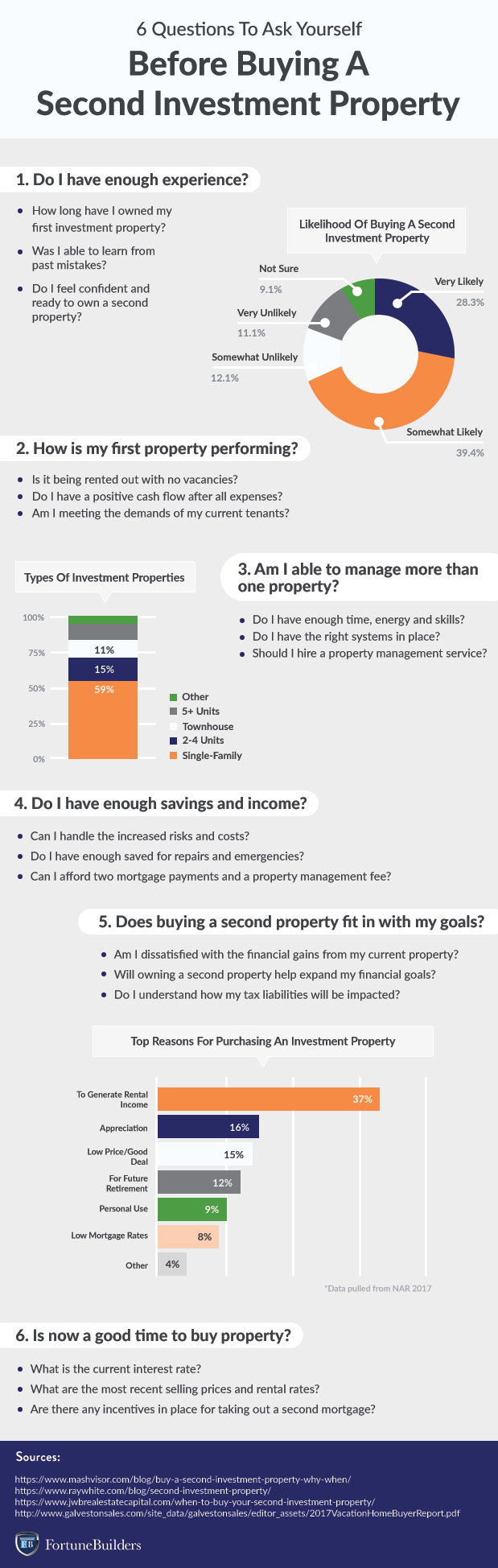

If your path is clear and you’re financially confident you can purchase a second home, here are a few tips to get started:

/GettyImages-1081824440-2fcd29d1f0974847af9b6f57a3d2ba6d.jpg)